The Financial Statement Analysis of Commercial Banks in Bahrain: A case study of Ahli United Bank

DOI:

https://doi.org/10.34069/RC/2020.5.02Palabras clave:

Financial performance, profitability liquidity, banks, Kingdom of Bahrain, return of equity.Resumen

Financial sector of kingdom of Bahrain intensely supports the growth of the economy. It contributed 27% of Bahrain GDP in 2018.The wellbeing of an economy can be examined by financial performance of the bank. Financial performance is the result of its policies and operations in monetary terms. The aim of the study is to examine the financial performance of the banks in Kingdom of Bahrain- A Case study approach. For the evaluation of the performance of bank, secondary data was collected from the annual audited report of the bank for the period of 2011 to 2017. It focuses on two important indicators the profitability and liquidity. As the shareholders are in need to maximize their return on investment and the depositors need to get back their savings according to their needs focuses on liquidity. To measure the profitability, return on asset and return on equity is the variable and loan to deposit and loan to asset to evaluate the liquidity. For this ratio analysis is being used to measure as it is evident from the previous studies. The study used percentage analysis, descriptive statistics and correlation the result of the analysis portrayed that return on asset and return on equity are positively correlated and negatively correlated with loan to asset.

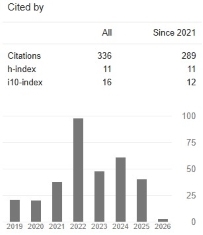

Descargas

Citas

Alshatti, Ali Sulieman. The effect of the liquidity management on profitability in the Jordanian commercial banks. International Journal of Business and Management, 2014, 10.1: 62

Alsamaree, Adnan Hashim (2013) Financial Ratios and Performance of Banks.Journal of Research in International Business and Management, vol3(1)17-19.

Ahmad, Rafiq. A Study of Relation between Liquidity and Profitability of Standard Charterd Bank Pakistan: Analysis of Financial Statement Approach. Global Journal of Management And Business Research, 2016.?

Bennaceur .S.&M.Goaied (2008) The determininets of commercial bank interest margin and profitability: Evidence form Tunisia”. Frontiers in Finance & Economics,5,No1,106-130.(retrievedfromwww.elsevier.com)

Bansal, R., (2014). “A Comparative Financial Study: Evidence from Selected Indian Retail Companies”, Journal of Finance and Investment Analysis, 3(3), 1335.

Bourke P (1989). Concentration and other Determinants of Bank profitability in Europe. Journal of banking and Finance, 65-80

Eccles, R. G. (1991). The performance measurement manifesto. Harvard Business Review, Harvard University, USA.

Eljelly.A.(2004) Liquidity – profitability tradeoff: an empirical investigation in an emergingmarket.IJCM .14(2),48-61.

Farooq Alani1, Hisham Yaacob &Mahani HamdanIslamic Banking: Evidence from Kuwait, , The Comparison of Financial Analysis Tools in Conventional and International Journal of Business and Management; Vol. 8, No. 4; 2013; ISSN 1833-3850 E-ISSN 1833-8119;

John Bajkowski, AAII Journal/August 1999; putting the numbers to work by Vice president of financial analysis and editor of Computerized Investing.

Khanfer and Matarna (2006) Khanfar, M., &Matarna, G. (2006). Analysis of financial statements the theoretical and practical (1st ed.). Dar Al Masira, Amman, Jordan.

Kosmidou.kpasiouras.fT saklanganos A(2007),Domestic and multinational determinents of foreign bank profits: The case of Greek bank operated abroad: International Financial Markets Instituions and Money 17.(2007)

.Larteyv ,AntwilS.Boadi.E (2013).The relationship between Liquidity and Profitabilty of Listed Banks in Ghana. International Journal of Business and Socialscience.4(3),71-86.

.Macharia, wambu timothy. The Relation between Profitability and Liquidity of Commercial Banks in Kenya. 2013.?

Matar, M. (2003). Financial and credit analysis - methods and tools and uses Process. Dar Wael Publication, Amman, Jordan.

Mohamed Abdulkarim Almumani (2014), A comparison of Financial performance of Saudi Banksb(2007-2011).Asian journal of Research in Banking and Finance,vol 4,No.2,2014,200-213.

Raj bahadur sharman,MDImdadul and Haque (2011),Benchmarking Financial Performance ofsaudi Banks using Regression .IJBEMR,VOL2,1,78-84.

Samad.A.(2004) Bahrain Commercial Banks performance during 1994-2001.credit and financial management review vol 1,33-40

Walther, T., Johansson, H., Dunleavy, J., & Hjelm, E. (1997). Reinventing the CFO: Moving From Financial Management to Strategic Management. McGraw-Hill, New York.4.4.1.